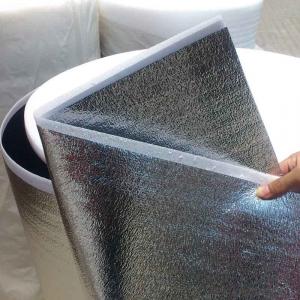

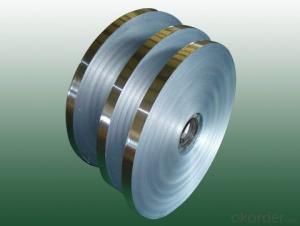

Aluminum Embossing Foil

Aluminum Embossing Foil Related Searches

Led Light Bulbs For Ceiling Fixtures Led Lamps For Ceiling 42 In Ceiling Fan With Light Aluminum Coil Stock For Gutters Aluminum Foil For The Grill Hole Saw For Aluminum Plate Aluminum Tread Plate For Trailer Bow Plate For Aluminum Boat Aluminum Foil For Grow Room Aluminum Foil For Joint PainHot Searches

Stock Price For Aluminum Aluminum Coil Stock For Sale Aluminum Gutter Coil For Sale Used Aluminum Scaffolding For Sale 1/4 Aluminum Plate For Sale Aluminum Bar Stock For Sale Aluminum Round Stock For Sale Aluminum Diamond Plate For Sale Aluminum Scaffolding For Sale Craigslist 6061 Aluminum Plate For Sale Aluminum Dock Plate For Sale 7075 Aluminum Plate For Sale Aluminum Tread Plate For Sale Aluminum Checker Plate For Sale Aluminum Plate For Sale Near Me Plate Aluminum For Sale Aluminum Plate For Sale Aluminum Square Stock For Sale Aluminum Flat Stock For Sale Billet Aluminum Stock For SaleAluminum Embossing Foil Supplier & Manufacturer from China

Okorder.com is a professional Aluminum Embossing Foil supplier & manufacturer, offers integrated one-stop services including real-time quoting and online cargo tracking. We are funded by CNBM Group, a Fortune 500 enterprise and the largest Aluminum Embossing Foil firm in China.Hot Products

FAQ

- How to choose the material when doing mechanical design

- Analysis of the advantages and disadvantages of this material, and then in the mechanical design manual can be found in the application of materials such as high-quality steel:

- Is there any common pattern between the two?While several ultra-Islamist countries have draconian laws to punish everyone who slanders god, CCP is known to punish everyone who slanders the Chinese Communist Party. CCP often resorts to informal detentions, punishments and disappearances which are completely outside the law, and so offer the government deniability and the victim no protection whatsoever.Do the Chinese people find any commonality between the Blasphemy Laws practiced in Islamist countries and the draconian policies of CCP?

- That's an interesting comparison. I'd have to say the similarity is remarkable!

- Which machinery makes this type of packaging /bags?

- I don't like links.

- I sold $30,000 in business assets(machinery,equipment)this year, how would I claim that on my taxes. would it be considered quot;other incomequot; or quot;capital gainquot;?

- It should be capital gain. I just wonder this $30,000 is all the proceed you have got from the sale or this is the difference between the proceed and the basis.

- green company purchased a piece of machinery on credit for 10,000.Briefly state how this transaction affect th?

- Green okorder

- Presented here are selected transactions for Snow Company for 2012.Jan. 1Retired a piece of machinery that was purchased on January 1, 2002. The machine cost $66,300 on that date and had a useful life of 10 years with no salvage value.June 30Sold a computer that was purchased on January 1, 2009. The computer cost $31,200 and had a useful life of 5 years with no salvage value. The computer was sold for $12,480.Dec. 31Discarded a delivery truck that was purchased on January 1, 2007. The truck cost $53,000 and was depreciated based on an 8-year useful life with a $6,300 salvage value.Journalize all entries required on the above dates, including entries to update depreciation, where applicable, on assets disposed of. Snow Company uses straight-line depreciation. (Assume depreciation is up to date as of December 31, 2011.)

- Jan. 1 Retired a piece of machinery that was purchased on January 1, 2002. The machine cost $66,300 on that date and had a useful life of 10 years with no salvage value. After 10 years the machinery is fully depreciated. Dr Accumulated Depreciation--Machinery 66,300 Cr Machinery 66,300 June 30 Sold a computer that was purchased on January 1, 2009. The computer cost $31,200 and had a useful life of 5 years with no salvage value. The computer was sold for $12,480. Six months of depreciation has accumulated since the beginning of the year. 31,200 / 5 x 6/12 = $3,120 to update depreciation Dr Depreciation Expense--Computer 3,120 Cr Accumulated Depreciation--Computer 3,120 31,200 / 5 x 3 1/2 = 21,840 total accumulated depreciation at time of sale Dr Cash 12,480 Dr Accumulated Depreciation--Computer 21,840 Cr Computer 31,200 Cr Gain on Sale of Computer 3,120 Dec. 31 Discarded a delivery truck that was purchased on January 1, 2007. The truck cost $53,000 and was depreciated based on an 8-year useful life with a $6,300 salvage value. (53,000 - 6,300) / 8 = $5,837.50 to update depreciation Dr Depreciation Expense--Truck 5,837.50 Cr Accumulated Depreciation--Truck 5,837.50 5,837.50 x 6 = 35,025 total accumulated depreciation at time of sale Dr Accumulated Depreciation--Truck 35,025 Dr Loss on Disposal 17,975 Cr Truck 53,000